Workers are seen on a crane above containers at the Yangshan Deep Water Port in Shanghai, China January 13, 2022. Picture taken January 13, 2022. REUTERS/Aly Song/File photo Acquire Licensing Rights

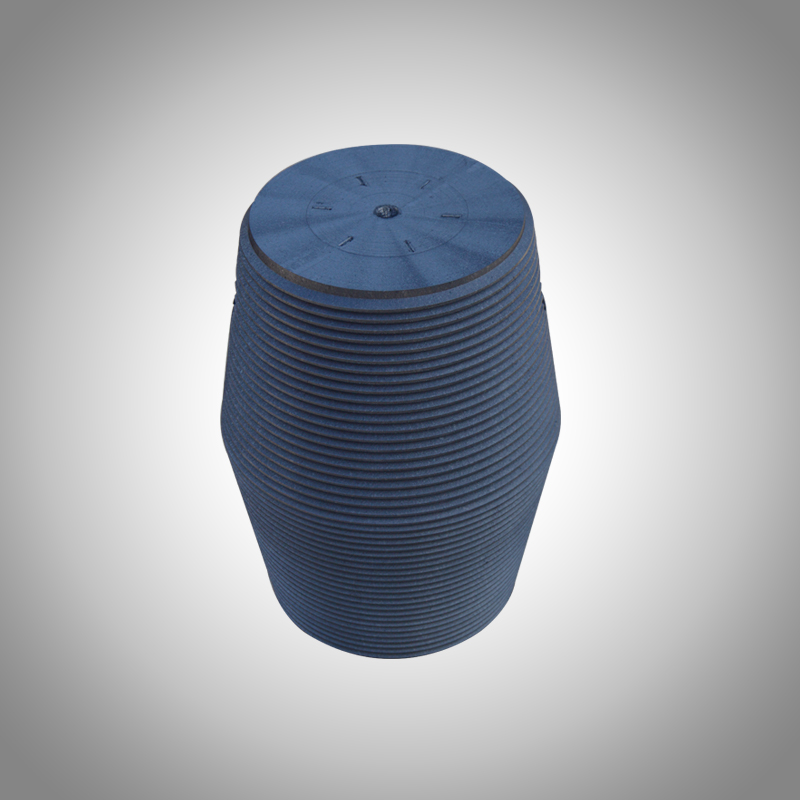

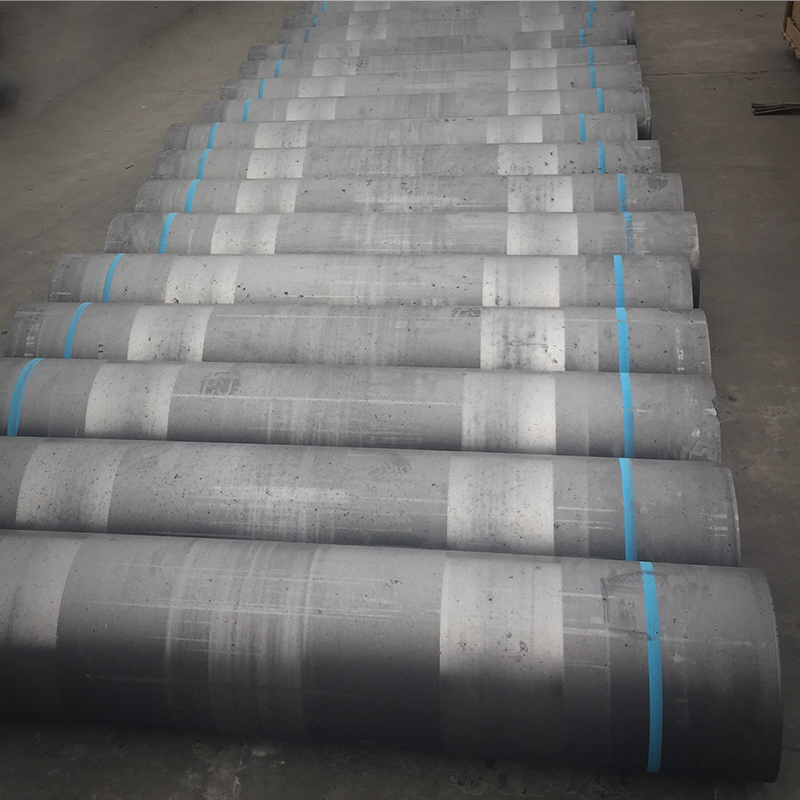

SINGAPORE/LONDON, Oct 20 (Reuters) - China will require export permits for some graphite products to protect national security, its commerce ministry said on Friday, in its latest move to control supplies of critical minerals in response to challenges over its manufacturing dominance. good conductivity graphite electrode

Here is what analysts and companies are saying about the measure:

IVAN LAM, SENIOR ANALYST, COUNTERPOINT RESEARCH:

"In addition to China, other countries and regions also implement graphite export controls. Graphite has a wide range of applications in industry, and the demand for its use is growing. We believe that the average price of graphite will continue to rise in the future due to supply and demand imbalances, including Russia, which was one of the major graphite suppliers before the Russia-Ukraine war.

"High-sensitivity graphite is a high-performance material with a wide range of applications in industries such as semiconductors, automobiles, aerospace, battery manufacturing, and chemicals.

"However, this control is not a complete ban, and there has been no significant impact on any industry during the previous temporary control."

CHRISTOPHER RICHTER, DEPUTY HEAD OF RESEARCH, CLSA IN TOKYO:

"It would be a bold step to cut off the world from graphite because I think the Chinese know that would bring EVs to a halt everywhere and probably would create escalation rather than de-escalation of some of the trade disputes going on with China - between the EU and China, between the US and China.

"I think what it (Japanese industry) probably will do, since the graphite is still there, is any research that you've got going on that can look for alternatives... probably becomes a lot higher priority and generally the solution is as to A) look for alternative sources and B) look for alternative materials."

KANG DONG-JIN, ANALYST AT HYUNDAI SECURITIES IN SEOUL:

"It's not that China would suddenly stop export graphite, but it would be more intensely regulated and reviewed. It is still unclear how far China would take this graphite export curb, which would determine the supply chains.

"With this new graphite export curb, South Korean firms - or South Korea in general, which heavily rely on China for graphite imports, would need to seek alternatives, such as mines from the United States or Australia, but it would likely increase cost burden for many."

ANDY LEYLAND, CEO OF SUPPLY CHAIN INSIGHTS:

“Graphite markets have been in oversupply, with falling prices, so the export licences don’t make sense from a market standpoint. They will worry the West, however, and be a boon to up-and-coming producers outside China.

“This is straight from China’s commodities playbook, and a direct response to moves in the West to legislate a move away from the country.”

KIEN HUYNH, CHIEF COMMERCIAL OFFICER AT ALKEMY CAPITAL INVESTMENTS, WHICH DEVELOPS PROJECTS IN THE 'ENERGY TRANSITION METALS SECTOR':

“This bold and unexpected move by China in graphite has taken us by surprise, arriving far sooner than anyone could have predicted. The juggernaut of the Chinese battery sector is moving forward at a blistering pace, outstripping the progress in Western markets. As they increase their consumption of the essential materials that Western battery manufacturers rely on, they tighten their grip on the industry.

“This turbocharges the urgency for the West to forge their independent supply chains, charting a course toward self-sufficiency in both the raw materials and the downstream components necessary to meet their own ambitious battery industry growth strategies. The race is on, and the stakes have never been higher.”

NEIL WILSON, CHIEF MARKET ANALYST AT BROKER FINALTO:

"Tit for tat – China says it might restrict graphite exports for use in EV batteries. It comes just days after the White House blocked sales of certain chips to China. It’s Trade Wars 2.0 and it’s inflationary."

Reporting by Brenda Goh in Shanghai, Daniel Leussink in Tokyo, Heekyong Yang in Seoul, Nick Carey in London and Christoph Steitz in Frankfurt; Compiled by Miyoung Kim and Josephine Mason; Editing by Nivedita Bhattacharjee and Jane Merriman

Our Standards: The Thomson Reuters Trust Principles.

Every great leader needs a Charlie Munger. The deputy to Berkshire Hathaway’s Warren Buffett died on Tuesday morning just a month shy of his 100th birthday. He dubbed himself the “cheerful pessimist,” delivering wry one-liners on the Omaha stage of the firm’s annual gatherings. But Munger’s best quality, being a sounding board for the boss who received the majority of the fame and fortune, might have made him Buffett’s best value investment.

Reuters, the news and media division of Thomson Reuters, is the world’s largest multimedia news provider, reaching billions of people worldwide every day. Reuters provides business, financial, national and international news to professionals via desktop terminals, the world's media organizations, industry events and directly to consumers.

Build the strongest argument relying on authoritative content, attorney-editor expertise, and industry defining technology.

The most comprehensive solution to manage all your complex and ever-expanding tax and compliance needs.

The industry leader for online information for tax, accounting and finance professionals.

Access unmatched financial data, news and content in a highly-customised workflow experience on desktop, web and mobile.

Browse an unrivalled portfolio of real-time and historical market data and insights from worldwide sources and experts.

Screen for heightened risk individual and entities globally to help uncover hidden risks in business relationships and human networks.

Isostatic Pressing Graphite All quotes delayed a minimum of 15 minutes. See here for a complete list of exchanges and delays.