Money market accounts are similar to savings accounts, but offer some checking features as well.

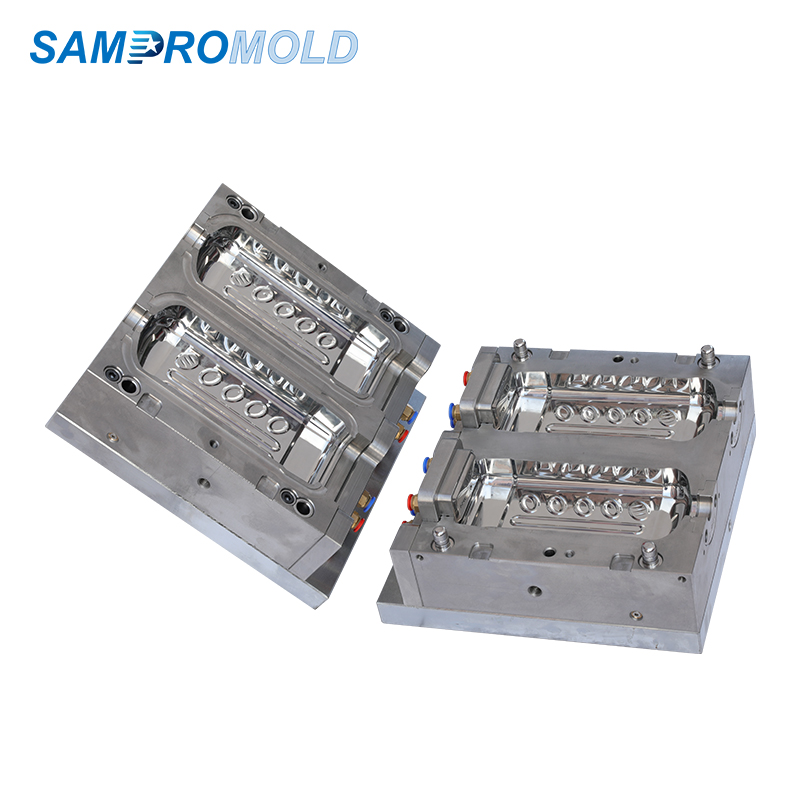

Skip the searching and find your next bank in minutes with BankMatch℠. Blow Moulding Water Tank

Home equity is the portion of your home you’ve paid off. You can use it to borrow for other financial goals.

Find an expert who knows the market. Compare trusted real estate agents all in one place.

Home insurance doesn't have to be a hassle. Choose the best home insurance company for you.

Life insurance doesn’t have to be complicated. Find peace of mind and choose the right policy for you.

Answer a few quick questions and we’ll show you your top credit card options.

See what the experts say

Read in-depth credit card reviews to find out which cards have the best perks and more.

Start making moves toward your money goals and compare your debt management options.

Boost your business with rewards, perks and more. Compare cards in one place to find the one for you.

Figure out funding for your next car or refinance with confidence. Check out today’s auto loan rates.

Drive with peace of mind when you compare insurance carriers and find the policy that’s right for you.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most — the different types of lending options, the best rates, the best lenders, how to pay off debt and more — so you can feel confident when investing your money.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Dealerships will offer prepaid car maintenance plans alongside other extras like extended warranties, credit insurance and anti-theft devices. They are not necessarily a bad deal. But the best way to decide if a prepaid maintenance plan is the right choice is to research expected maintenance costs — then compare these with the price you’re offered.

If you plan to add the prepaid maintenance plan to your auto loan, it may make more sense to instead keep a savings account for expected maintenance costs where you earn, rather than pay, interest.

Prepaid car maintenance plans are contracts that cover scheduled and expected maintenance. Unlike extended warranties, they only pay for preventative maintenance, like tire rotations and oil changes. The manufacturer warranty or extended warranty will still cover unexpected repairs.

A prepaid maintenance plan may enter the discussion when buying a new vehicle that doesn’t have scheduled car maintenance built into the retail price or when purchasing a used car that the manufacturer no longer covers.

Either way, be sure to ask whether the offered plan can be used at an independent mechanic’s shop or if it is limited to service at the dealership. Many such plans only allow service at the selling dealership, limiting your options for future maintenance.

Depending on the prepaid maintenance plan you are considering, maintenance may be limited to specific intervals (for instance, oil changes only being covered every 10,000 miles). Some prepaid plans only cover services once a calendar year or every six months, so depending on how much you drive, you may need additional paid maintenance on the vehicle.

Several manufacturers — such as Jaguar, Toyota, BMW, Volvo, MINI and Land Rover — offer prepaid maintenance plans. Some of these factory plans also include wear-and-tear items, such as windshield wiper blades and brake pads, but some don’t, so it’s critical to research before heading to the showroom.

As with most aspects of the car-buying process, doing the math before sitting down with the dealer is the key to saving money. Compare the price of the plan with the estimated cost of the scheduled or out-of-pocket costs during the covered period.

Your owner’s manual should list the maintenance you’ll need and when you’ll need it. Call the dealer service manager and ask for a breakdown of scheduled maintenance costs. You can also tally up costs yourself by considering the cost of maintenance, insurance, and other expenses.

If the estimated cost for scheduled maintenance of your new car for its first 30,000 miles is $400 and you pay $800 for the plan, a prepaid car maintenance plan is ultimately not worth it. If you pay $250 for the plan, you save money.

You can strike a balance but remember: If you include the prepaid maintenance plan as part of your loan, calculate how much you’ll pay in interest alongside the flat maintenance cost to get an idea of the full cost.

Don’t just agree to a prepaid maintenance plan. Before you set foot in a dealership, know the expected maintenance costs for the vehicles you’re interested in. And keep these pros and cons in mind when you negotiate.

Prepaid maintenance plans are negotiable — so don’t just agree to the price offered by the dealership’s finance office. If you know the potential cost of regular maintenance, you can plan ahead and avoid the stress of deciding when and where to take your vehicle.

However, it’s not the best choice if you already have a trusted mechanic or body shop or do not plan on staying in the area where you purchased the car. And if you wrap a prepaid maintenance plan into your auto loan, you could pay more in interest than the maintenance is worth. Be mindful of your loan’s interest rate, and don’t hesitate to negotiate the car’s overall price.

To determine whether a prepaid maintenance plan will benefit you, take the time to research expected costs and compare it to what the dealership offers.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Bankrate, LLC NMLS ID# 1427381 | NMLS Consumer Access BR Tech Services, Inc. NMLS ID #1743443 | NMLS Consumer Access

Injection Molding Plastic Bottles © 2023 Bankrate, LLC. A Red Ventures company. All Rights Reserved.