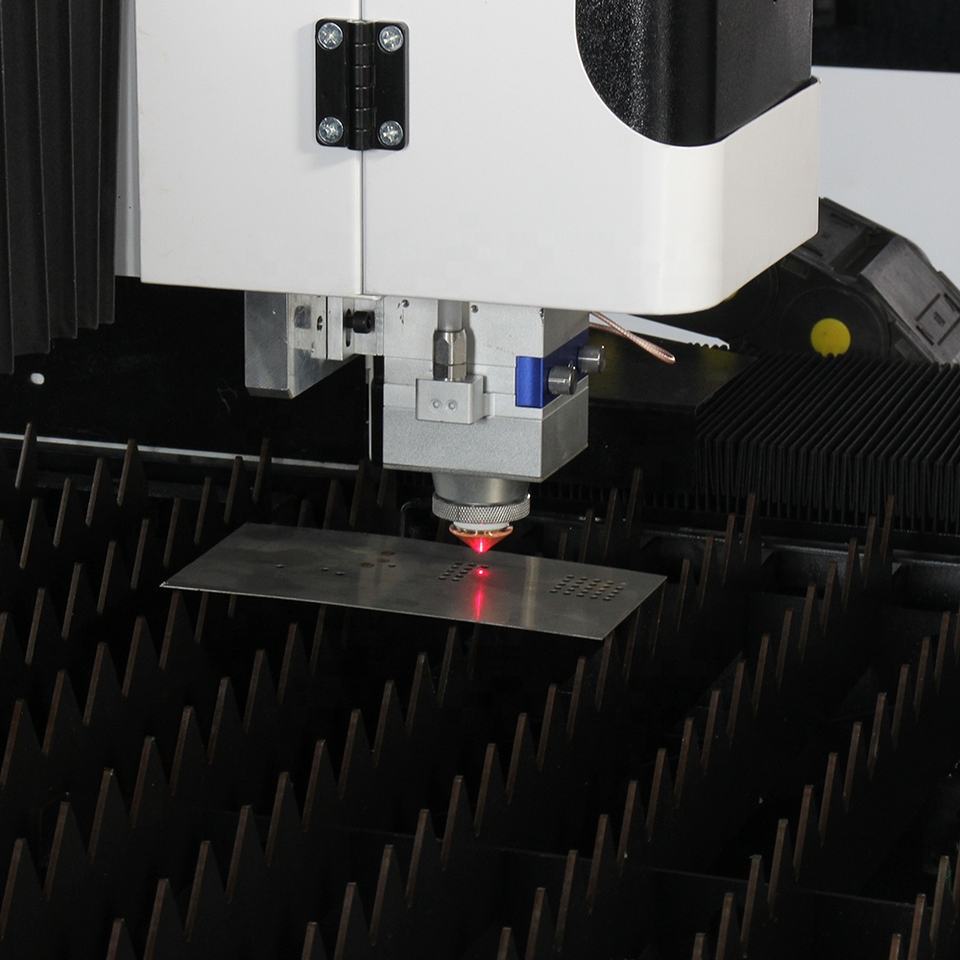

Laser cutters have developed into an integral tool for small- and medium-sized manufacturers (SMMs), due to their efficiency and productivity.

The machines have broad uses, letting companies cut metal, paper, fabric, wood and other materials. Thanks to continuing technical improvements, SMMs can better satisfy customers with intricate designs and precise cutting. Chemical Anchor

While laser cutters are effective, they can bring steep upfront costs for business owners. Other factors and considerations include power consumption, what type of gas is used, maintenance and repairs, and workforce issues.

So, when should SMMs expect to breakeven on such purchases? Here’s what they should expect regarding return on investment (ROI).

The ROI timeline for laser cutters varies by company and application. Sometimes, even minor changes significantly affect the cost of laser cutter operations, according to industry experts.

The ROI depends on a company’s production and local demand. A high-production shop could net a profit within six months to a year. However, a smaller business with only a few staff members could wait nearly two years before seeing a positive return. ROI will depend on how much the company charges, as well as revenue streams in the first few months of operation.

Business owners should also consider market conditions. Supply chain disruptions and inflation have led to volatile prices in recent years.

Dirk Burrowes, president of Fitchburg, Mass.-based Vytek Industrial Laser Systems since its founding in 1988, says the past few years have forced businesses to make major changes. ROI, as a result, has become more unpredictable.

“Given the supply and labor crisis, it became a requirement to move manufacturing in-house or go out of business altogether,” Burrowes says. “Those companies who did successfully move manufacturing in-house were pleasantly surprised that payback was, in many cases, less than six months.

“Like any ROI calculation, it depends on many factors, but the metric has become a lot easier to justify with the costs of the technology falling so quickly.”

Tight budgets are the norm for small companies in the laser-cutting industry, so finding ways to save money and accelerate ROI is critical. First, business owners should explore different laser-cutting techniques to heighten productivity and lower costs.

For example, many operations have experienced good fortune with rapid prototyping. This technique has further advanced thanks to ongoing improvements in additive manufacturing (AM) and 3D printing, which are valuable in shortening development cycles and permitting more flexibility in design, thus letting small laser-cutting businesses shine with innovative creations.

Laser cutting and 3D printing have benefited from the recent rise in low-cost diodes and fiber laser technology. Manufacturers have upgraded LEDs and their capacities while keeping costs low. This change has trickled down to help laser-cutting businesses invest less capital in their machines, improving ROI.

“In 30 years of business, I have never seen the cost of a technology-based product literally drop 200-300% a year,” Burrowes says. “This has fundamentally changed the cost structure for manufacturers of laser cutting, welding and marking equipment.

“It has also changed the 3D-printing markets, as well as other laser-related industries. The result is a flood of laser equipment targeted toward small- to mid-level companies looking to offset the rise in cost for their outsourced items.”

Taxes are another consideration. Companies can deduct depreciating assets, including vehicles and software. However, this deduction also applies to tangible equipment in a trade or business. It also applies to real property and property used for lodging.

Section 179 of the IRS code allows a maximum deduction of $1 million, but it phases out at $2.5 million. Business owners should track the maintenance and repairs needed throughout the year to accurately record deductions.

Estimating ROI is challenging due to unknown variables, but small-business owners can paint a clearer picture when they understand the contributing factors.

First, it’s essential to understand the laser cutter market as a whole. Grand View Research predicts a steady 5.5% compound annual growth rate (CAGR) for this sector through 2030. Laser cutters are growing in demand due to more companies using automation. Whether their business works on automobiles, textiles or electronics, they require laser-cutting services.

Higher demand for laser-cutting services will likely lead to more innovation and heightened efficiency with these machines, according to Grand View. For example, the desire for energy-efficient technology will help lower costs associated with power consumption. Some businesses run their laser cutters 24/7, so selecting an efficient machine is imperative.

While some laser cutters are automated, most small businesses require human labor. These machines need at least one person to run them—larger laser cutters may need two or three staff members to produce the best results. Employing multiple workers on a laser cutter may be best for safety reasons.

However, SMMs may need help with staffing. The past few years have seen an uptick in manufacturing hiring, but there are still about 616,000 vacant jobs to be filled.

Another factor small businesses should consider is maintenance. Laser cutters require daily, weekly and monthly upkeep to ensure they run whenever needed. Employees must perform small tasks, such as lubricating the laser cutter. More expensive duties may include swapping the machine’s filters. Businesses could see downtime and a negatively affected ROI timeline if employees don’t follow these procedures.

Alloy Wire Needless to say, companies need to do their homework before purchasing a new laser cutter. Due diligence will help short- and long-term planning, allowing for realistic expectations as they grow their operations and experience maximum ROI.