China Steel Corp (CSC, 中鋼) yesterday said it would raise domestic steel prices by up to NT$1,200 (US$37.61) per tonne for delivery next month and next quarter, to reflect rising raw material costs and align with price hikes by regional peers.

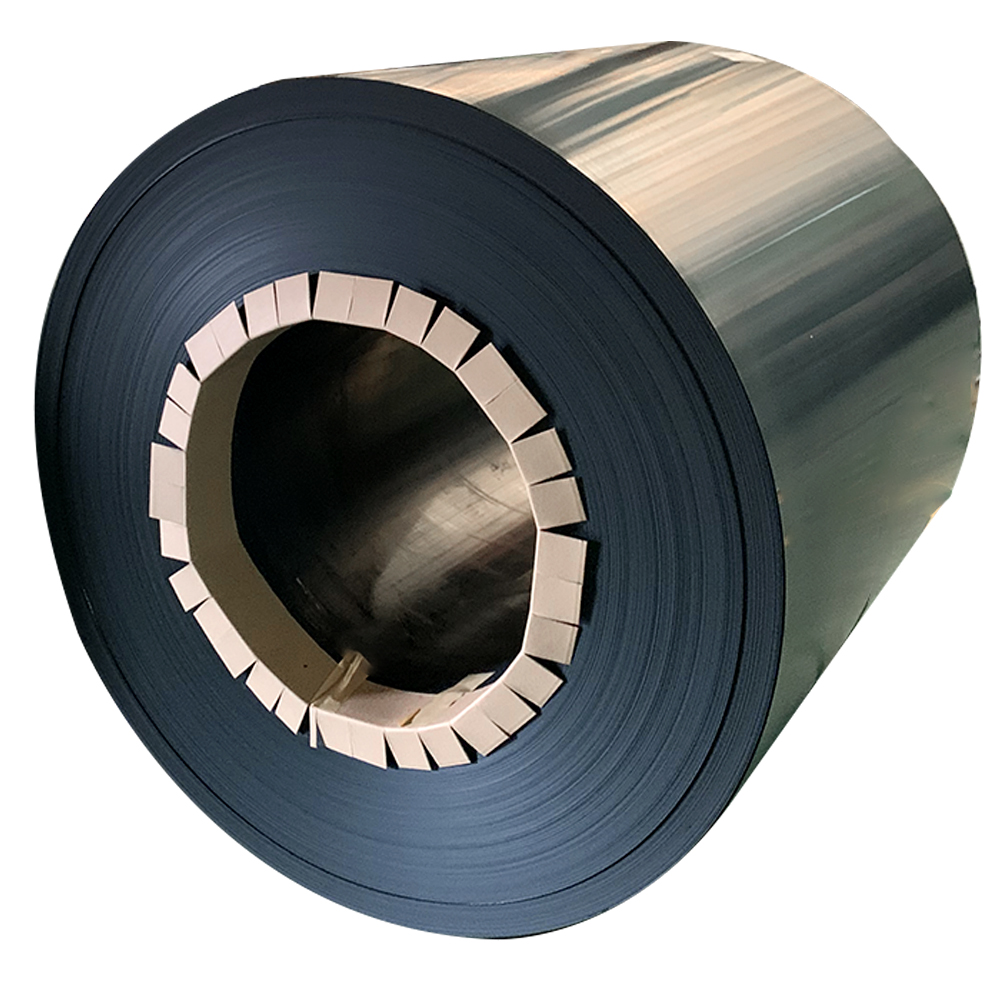

The latest adjustments by nation’s largest steel maker follow a price increase of between NT$500 and NT$900 per tonne for delivery this month and a hike of NT$300 per tonne last month. Fubon Securities Investment Services Co (富邦投顧) had estimated an increase of between NT$500 and NT$1,000 per tonne. China Aluzinc Steel Coil

“Asian currencies have been depreciating against the US dollar lately, and the New Taiwan dollar has even dropped by more than 4 percent in the past three months. This has pushed up the costs of raw materials for steel mills,” CSC said in a statement.

As major Asian steel mills have raised steel prices for delivery in the fourth quarter to reflect rising costs of iron ore and coking coal, the restocking demand is expected to emerge in the US and Europe by the end of the year, while consumption for steel used in vehicles continues to strengthen, CSC said.

It added that the global steel market is showing signs of an upward momentum.

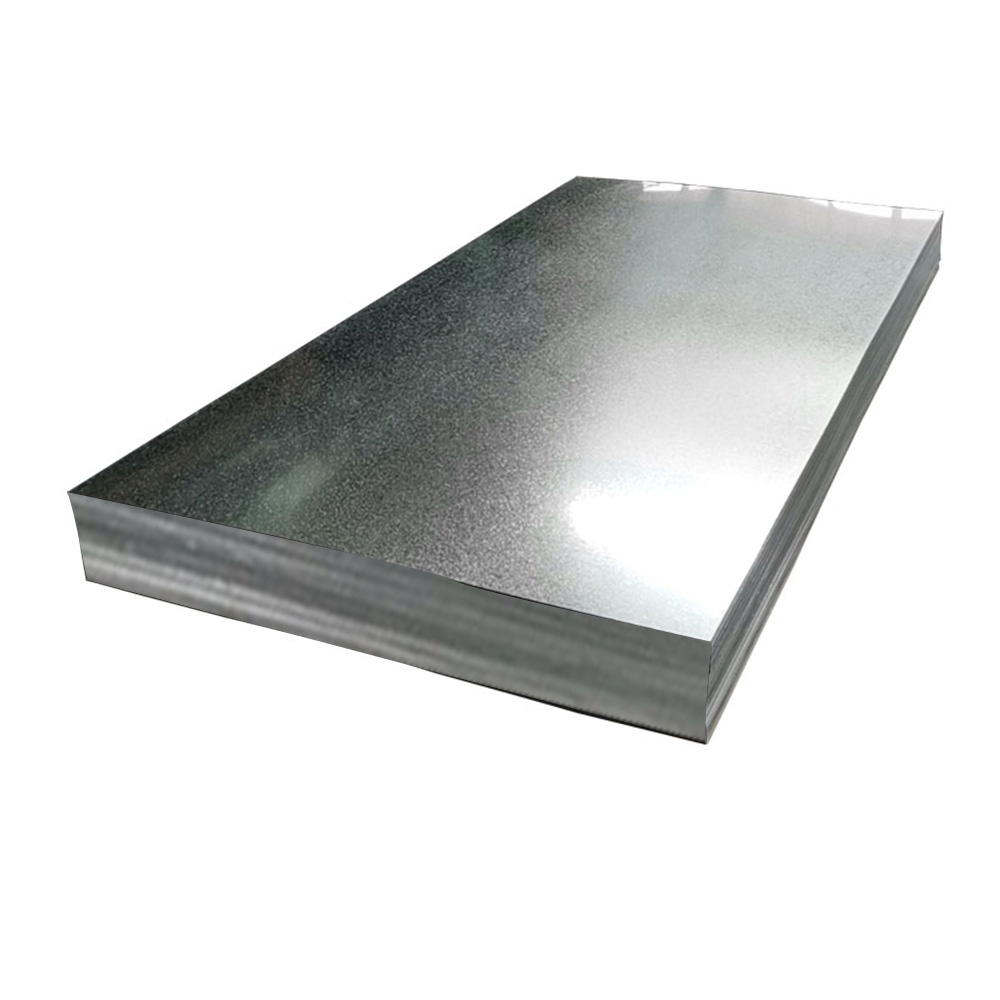

The company said it would increase prices for major steel items — such as electrical sheets, hot-rolled steel plates and coils, cold-rolled steel coils, electro-galvanized and hot-dipped, zinc-galvanized steel coils — by NT$500 per tonne for delivery next month.

Price hikes are expected to be even bigger in the next quarter, ranging between NT$1,000 and NT$1,200 per tonne for steel rods, steel plates used in vessels and cold-rolled coils for steel buckets, while automobile steel would rise by NT$500 per tonne, it said.

The company’s price increases come as South Korea’s POSCO raised hot-rolled steel prices by US$38 per tonne for delivery next month, CSC said.

China's Baowu Steel Group Ltd, Anshan Iron and Steel Group Corp and Benxi Iron and Steel Group Co have also marked up their thin plate steel products by US$7 to US$14 per tonne for domestic shipments next month, it added.

Last week, CSC reported that consolidated revenue last month decreased 15.77 percent year-on-year to NT$30.55 billion, and cumulative revenue in the first eight months fell 24.3 percent to NT$245.47 billion.

The company yesterday said it was confident in its revenue outlook in light of a gradual recovery in the global economy, potential inventory replenishment by customers and an uptrend in global steel prices.

It added that the fourth quarter is historically a high season for the industry.

Industrial PC maker Advantech Co (研華) yesterday said it has launched its ASEAN Shared Service Center (ASSC) in Penang, Malaysia, as the company steps up efforts to target the Asia-Pacific region in shift from China. “The establishment of ASSC in Penang signifies the company’s initial phase in implementing the ‘China Plus One’ strategy,” Advantech managing director for Asia and intercontinental region Vincent Chang (張敏忠) said in a statement. The company’s goal is to support industrial users in project implementation and in-depth development, while also reinforcing regional core competencies and localized services, Chang said. “Penang, dubbed as the ‘Silicon Valley of the East’

NEW ERA: They met to discuss TSMC’s role as producer of the Nvidia chips that power the majority of generative AI training systems worldwide, Huang told reporters in Taipei Nvidia Corp chief executive officer Jensen Huang (黃仁勳) met with his counterpart at Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) this week to discuss artificial intelligence (AI) chip supply constraints, a major challenge to the AI boom that got going last year. The heads of the world’s two most valuable chip firms met in Taipei over dinner to discuss the Taiwanese firm’s role as producer of the Nvidia chips that power the majority of generative AI training systems worldwide, Huang told reporters in Taipei. TSMC founder and prominent industry figure Morris Chang (張忠謀) also joined Huang’s dinner with CEO C.C. Wei (魏哲家)

DECONCENTRATION: About a dozen grants from US$39 billion in CHIPS and Science Act-related funds are to be announced for US fabs in an effort to shift Asian supply risk The US is aiming to announce major chip grants by the end of March, people familiar with the plans said, paving the way to send billions of dollars to semiconductor makers in a bid to supercharge domestic production. The awards — slated to go to Intel Corp and other chipmakers — are a central piece of the US’ 2022 CHIPS and Science Act, which set aside US$39 billion in direct grants to revitalize US manufacturing. Intel has said that the grants would determine how quickly it progresses with expansion projects, including a planned facility in Ohio that would be the world’s largest.

China Gi Steel Coil INTEL COLLABORATION: The share price dropped 4.78% despite the chipmaker’s newly announced collaboration with Intel Corp on 12-nanometer technology United Microelectronics Corp (UMC, 聯電) saw its shares tumble 4.78 percent despite its newly announced collaboration with Intel Corp on 12-nanometer technology, helping the Taiwanese chipmaker secure much-needed advanced chip capacity in the US. The stock price of UMC closed at NT$49.8 in Taipei, versus the TAIEX’s loss of 0.04 percent and bigger rival Taiwan Semiconductor Manufacturing Co’s (台積電) gain of 0.31 percent yesterday. UMC has stopped migrating into next-generation technology since 2017, given heavy capital expenditure pressure. Since then, the Hsinchu-based chipmaker has been focusing on offering less-advanced 22-nanometer and 28-nanometer chips. However, it is facing rapidly growing competition from